An In-Depth Look at Closing Costs and Their Contents

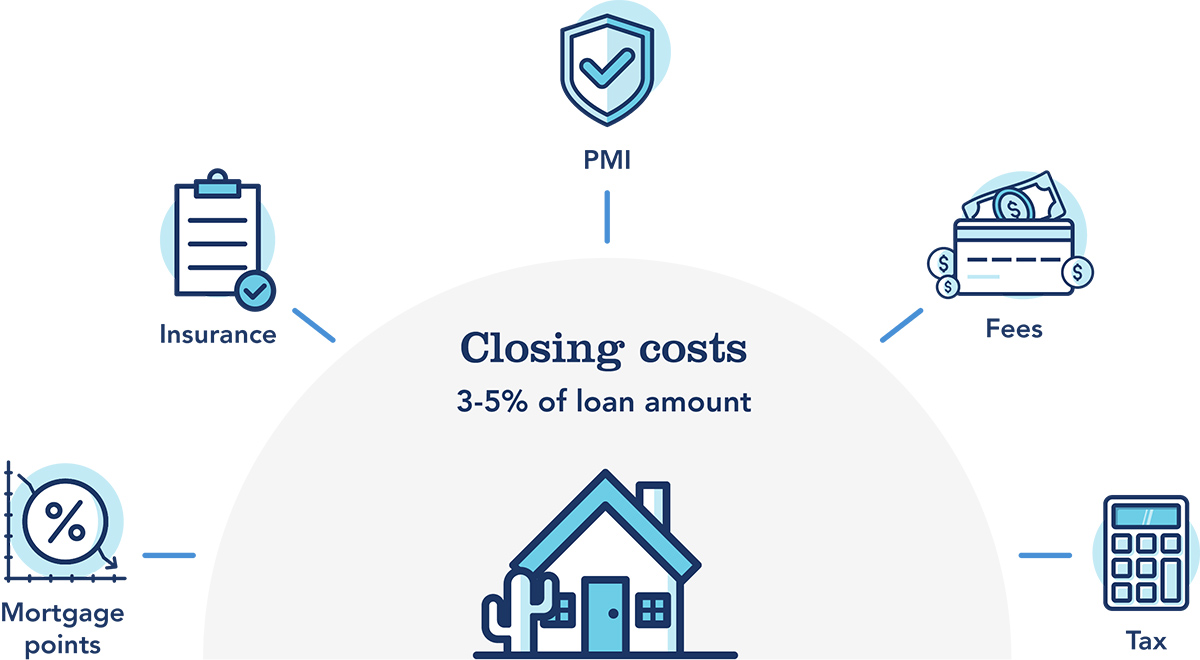

Closing costs are a necessary part of any real-estate purchase, encompassing numerous fees and bills sustained beyond the property's obtain value. Understanding what these costs include may help equally buyers and sellers get around the monetary facets of closing an agreement effortlessly. Here is an extensive guide to what do closing costs include usually encompass:

1. Financial loan-Relevant Fees: Origination Costs: Charged from the financial institution for handling the money program. It handles admin costs and is usually a amount of the money amount. Details: Recommended costs paid upfront to reduce the rate of interest on the house loan. One point equates to 1Per cent from the loan amount. 2. Third-Party Service fees: Assessment: The charge for any expert evaluation to look for the property's market price. Credit Report: Cost for tugging the buyer’s credit score to gauge their creditworthiness. Headline Lookup and Insurance policy: Guarantees the home features a crystal clear title and protects against any legitimate promises. It contains title lookup costs and name insurance costs. Escrow Charges: Incurred from the escrow company or legal professional dealing with the closing approach. 3. Prepaid Expenses: House Taxation: Master-graded figure to protect taxation from the closing particular date towards the finish of your taxation time. Homeowners Insurance: Prepayment to the first year’s home insurance coverage. Attention: Curiosity in the home mortgage from the closing time to the end of your calendar month. 4. Authorities Charges: Saving Charges: Paid for on the region or metropolis for recording the new residence acquisition documents. Shift Taxation: Imposed by express or nearby governing bodies in the exchange of real estate property possession. 5. Additional Costs: Residence Evaluation: Recommended but recommended for buyers to assess the property's condition. Survey: Can determine the home limitations and makes certain you will find no encroachments. Home Guarantee: Includes improvements or replacements of home methods and devices. 6. Seller’s Closing Costs: Real Estate Commission: Typically the largest price for retailers, paid being a portion of the home’s transaction cost to the listing and buyer’s agents. Excellent Liens or Decision: Any debts or authorized statements up against the property that really must be settled before closing. Knowing the Total Costs: Closing costs can differ significantly in accordance with the property’s location, acquire selling price, and bank loan sort. Customers should get a Loan Quote (LE) from the lender outlining expected costs within three days of obtaining a home financing. Additionally, a Closing Disclosure (CD) offered 72 hours before closing particulars the last costs. Discussing Closing Costs: Equally sellers and buyers can work out who pays off certain closing costs as part of the purchase agreement. Sometimes, sellers may consent to include some costs to aid the sale, while customers might opt to pay out greater upfront costs in exchange for a lower monthly interest.

Conclusion: Closing costs are an inescapable component of buying or selling a property, requiring mindful budgeting and planning. Being aware of what these costs entail empowers each party to understand the closing method with transparency and monetary preparedness. By working closely with real estate professionals and loan companies, folks can effectively deal with and expect these expenses, guaranteeing a smooth changeover to homeownership or residence sale. By grasping the constituents of closing costs, buyers and dealers alike can method the very last steps of any real-estate financial transaction with lucidity and confidence.